This post is sponsored by First Alliance Credit Union

When you teach children about finances, you’re giving them skills that will help them for the rest of their lives. However, trying to explain money management in simple terms can be challenging to a child whose biggest financial concern is earning enough to buy an LOL Surprise or Ninjago Lego set. Let’s make this not boring!

There is a simple method that can help you teach children how to manage their money. It’s called the Save, Share, and Spend plan, and it’s a simple, effective way to teach children the basics of budgeting and money management.

Save

Save

While the benefits of saving money are well-known to adults, teaching a child to save their money can be difficult. Children can feel as though being told not to spend all their money ruins their fun without providing a tangible benefit.

You can help children understand why they should save money by helping them come up with financial goals. Sit down with them and talk about what they might like to buy, such as a video game, a toy or a piece of sports equipment.

When setting goals, be sure to make them SMART goals—Specific, Measurable, Achievable, Realistic and Time-Bound. This helps children (and adults!) better define their goals, making them more likely to succeed.

While piggy banks are a popular option to help children save money, you may also want to think about helping your child set up a youth savings account. This will put your child’s money out of their immediate grasp and help them avoid the temptation of spending it. Even better, your child will get to see the money accumulate in their account, and they will also be able to track any interest their money earns.

Share

Sharing money might seem like the hardest concept to teach children at first glance, but children are often empathetic, and they usually love helping people out. By teaching them to share early, you can help them feel confident that they can make a difference in the world.

Talk with your child about the people they would most like to help, then help them select an organization that is helping the people your child wants to help. You’ll also want to help your child select how much they want to share. Around 10%-20% is a good number to aim for.

Spend

The easiest concept for a child to understand is spending money. Outside of the obvious immediate gratification, it’s also the simplest concept to understand—give someone money, get something nice in return.

When talking to a child about spending money, you want to help them learn two important concepts.

The first concept is not spending all the money they have. If they get into the habit of putting some of their allowance aside, they’ll develop the mindset of spending only some of what they get while saving the rest for later.

The second concept is prioritizing what to buy. Have your child write down everything they would like to buy over a period of time, like a week or month. Then have them list how much money they have coming in, not just from allowances, but also from birthdays and other holidays. For older kids, it could even be from babysitting jobs or from helping a neighbor with yard work.

Once you’re done, help your children balance their list of what they want to buy against their available money. Help them see what they can and can’t buy during the week. You can also help your child figure out how to buy a more expensive item over multiple weeks.

Help Your Child Save, Share, and Spend with First Alliance Credit Union

Being able to Save, Share and Spend money effectively is the essential building block of finances. By teaching children how to do each step, you’re preparing them to successfully budget their money in the future. To help you teach these important concepts to your kids, First Alliance Credit Union has put together a fun packet of free printable pages that include:

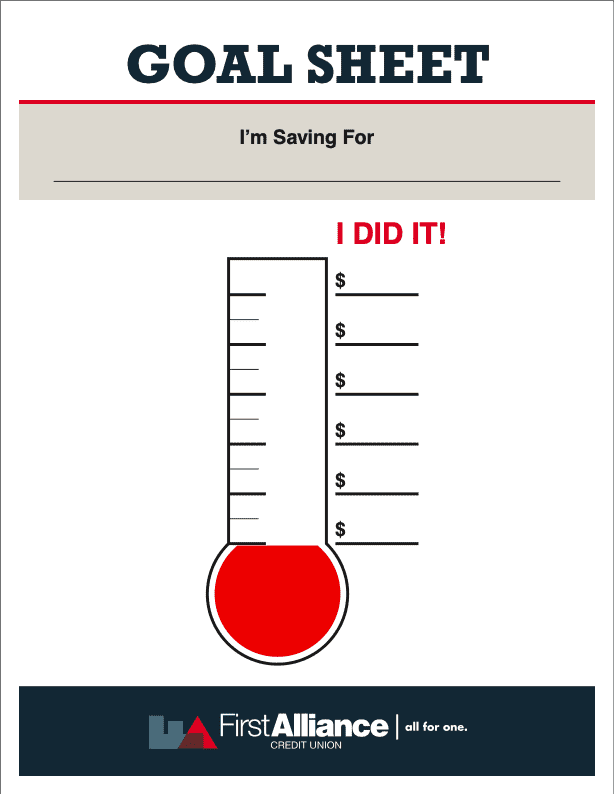

- Savings Goals Tracker

- Save, Share, Spend Labels

- Save, Share, Spend Tracking Sheet

- Plus, 10 More Ideas for Teaching Money Skills

Of course, if you want to help your children get more experience with Save, Share and Spend, get them their own youth account at First Alliance Credit Union. You’ll be giving them an account that will let them start putting into practice everything they’ve learned. All it takes to get started is $5.00. Plus, you can download the First Alliance Credit Union mobile app so your child can see how much money is in their savings account at any time.